ENVIENTA token ecosystem

ENVIENTA token ecosystem

UPDATE: This article is outdated! For more information, visit our brand new ICO page, and read our WP: https://ico.envienta.com/

During the ENVIANTA ICO, we’ll release 1 200 000 ENV tokens. When and if we reach the hard cap (5000 ETH), we will release 545,000 token which is the maximum amount — excluding bonuses. A small portion of the remaining amount is available for bounty and there is also a small part of for the founders. Additional tokens are will be released only for investment purposes, if it needed. This means that the number of tokens actually in circulation will not exceed the number of tokens allocated in the ICO in short term.

ENV is the official currency of ENVIENTA, this is a similar currency to bitcoin, ether etc., and it will be accepted by ENVIENTA and ENVIENTA partners for their services.

Although ENV is not just a currency, it has some special features:

- Regardless of the market price of the tokens, ENVIENTA and ENVIENTA partners always accept tokens at the minimum ICO price (1 ETH = 100 ENV). For these services, the value of the tokens cannot drop below the selling price! (However, it may increase.)

- ENV is a Bancor-like token whose liquidity is provided by 10% ETH coverage. The ENVIENTA project will allocate a minimum of 10% of its profits to this cover (the rest will be spent on further development and growth). The collateral pool will be strengthened if the collateral reaches 10% of the ICO market cap. From then on, the market cap, and the guaranteed exchange rate will increase with the growth of the company in an optimal case. The Bancor collateral pool is a kind of special stock market where tokens can be sold on demand or the sold tokens can be purchased at a pool price.

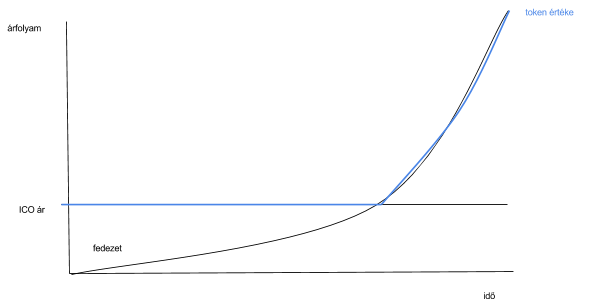

The price of the tokens in an ideal case:

As you can see, the initial cover starting at 0 and increasing until it reaches the ICO price. Up to this point, we count with tokens at ICO price. If the collateral reaches the ICO level, depending on the success of the project, the collateral begins to crawl up together with the token. Because how the Bancor formula works, if many of the owners/investors are selling their tokens, the price of tokens may fall, so this is an ideal case where most of the tokens issued are in remains in circulation because:

- they are held by the owners in the hope of a higher exchange rate,

- or they are using it as a currency for vacation, education, shopping, crowdfunding, etc.

and the sold tokens are bought by others for one of these two reasons.

As tokens are released in small numbers and in limited quantities, there is a guaranteed acceptance network (ENVIENTA and partners) and have growth potential, so the above-mentioned exchange rate growth is realistic in the long run.

Why did we choose this model?

The general operating mechanism of traditional ICO models is that the services offered can only be accessed using ICO tokens. For example, in Ethereum, only ETH payment can be used to run Smart Contracts. As the given token exists only in a limited number, therefore, the market will increase the demand for tokens and thus the exchange rate of tokens.

This model is unsuitable in our case because if we restrict the payment methods to only accept ENV token for the services, we would exclude many others (for example, those who do not understand the operation of cryptocurrencies). Therefore, we have decided to accept multiple currencies as a payment instrument, but a minimum of 10% of the resulting profit is a collateral behind the ENV tokens. With this solution, the growth in value is also reflected without making the currency exclusive for the payment.

Let’s see each case:

- The service is used by ENV payment. In this case, the ENV will be returned to ENVIENTA and will be out of circulation. Since the value of the collateral does not change, the volume of tokens in circulation will be reduced, the price of tokens will increase.

- The service is paid in a different currency. In this case, profit is generated, which increases the coverage, thus increasing the value of tokens.

- Someone reimburses the ENV that he owns. Due to the Bancor formula, the value of the tokens will be dropped for a while, but because the tokens are remaining in the smart contract, from where can be purchased at a lower price. If someone buys the token, the exchange rate will reset. This is actually the same as an average stock transaction where someone sells a token to someone, just the time of the sale and the purchase not happening at the same. If the token is not bought by anyone, because of the two options above, the coverage per one token will be increased in any case if someone is using the services for a token or other currency, so the exchange rate will be restored at that time.

It can be seen easily that the value of tokens will only be reduced in the long run if there is no demand for the services at all. If ENVIENTA as an organization works well, the value of tokens will increase in the long run as a result of the model above.

If you would like to receive bonuses from the sale of ENVIENTA’s starting soon ICO token, you must also subscribe to our whitelist. What we can guarantee is that the whitelist subscribers get the first notice of whether the campaign started. This will entitle you to 30% bonus or later 15% bonuses. The whitelist is available here: http://envienta.com/whitelist.php